A deep dive into car loan calculators: making informed financing decisions

A deep dive into car loan calculators: making informed financing decisions

A Deep Dive into Car Loan Calculators: Making Informed Financing Decisions

A Deep Dive into Car Loan Calculators: Making Informed Financing Decisions

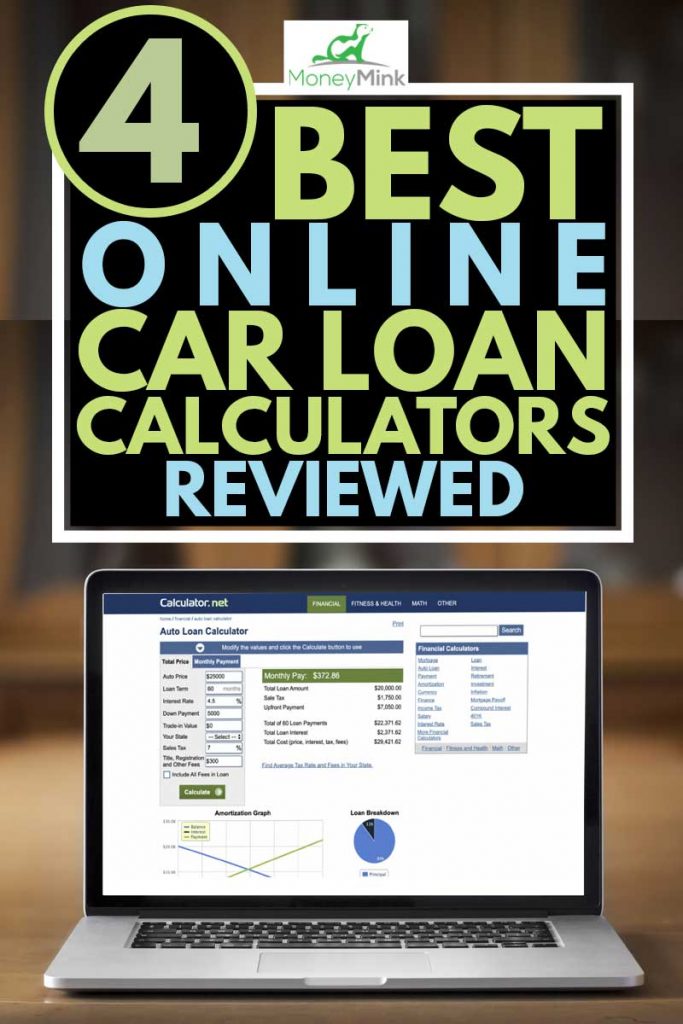

Car loan calculators are invaluable tools for anyone seeking to finance a vehicle. These online calculators allow prospective borrowers to estimate monthly payments, total interest accrued, and the overall cost of a loan based on various factors, such as the vehicle's price, loan term, interest rate, and down payment. By inputting their specific financial circumstances, individuals can gain a clear understanding of the potential financial implications of different loan scenarios and make informed decisions about their financing options.

Car loan calculators have become increasingly popular in recent years, driven by the growing accessibility of online financial tools and the desire for greater transparency in the auto financing process. These calculators provide a quick and convenient way for individuals to explore their financing options without the need for multiple consultations with lenders. Moreover, they empower borrowers to compare offers from different lenders and negotiate favorable terms, potentially saving them significant amounts of money in the long run.

While car loan calculators are generally simple to use, it is crucial to understand the underlying factors that influence the calculations. This article delves into the intricacies of car loan calculators, exploring the variables involved, the different types of calculators available, and the advantages and limitations of using them. By gaining a deeper understanding of these tools, individuals can effectively leverage them to make sound financial decisions when financing a vehicle.

FAQs about Car Loan Calculators

This section addresses common questions and misconceptions related to car loan calculators, providing clarity on their function and utility.

Question 1: What factors influence the results of a car loan calculator?

The results of a car loan calculator are determined by several key factors, including the vehicle's price, the loan term (duration), the interest rate, and the down payment. The calculator considers these variables to estimate the monthly payment, total interest paid, and total loan cost.

Question 2: Are car loan calculator results accurate?

Car loan calculators provide estimates based on the information entered by the user. While they are generally accurate, it is important to note that they may not reflect the precise terms offered by a lender. Loan terms and interest rates can vary depending on the lender's policies, the borrower's credit score, and other factors.

Question 3: Can I use a car loan calculator to compare loan offers from different lenders?

Yes, car loan calculators can be a valuable tool for comparing loan offers. By inputting the same loan information into different calculators, you can see how the estimated payments and total loan cost differ based on varying interest rates and terms offered by different lenders.

Question 4: How do I find a reliable car loan calculator?

Many reputable financial institutions and websites provide car loan calculators. Look for calculators from trusted sources, such as banks, credit unions, or financial websites with a history of providing accurate financial tools. Be cautious of calculators on websites that may not be transparent about their calculations or that promote specific lenders.

Question 5: Can car loan calculators help me determine the best loan term?

While car loan calculators can help you compare different loan terms, determining the optimal term depends on your individual financial circumstances. A longer term generally results in lower monthly payments but higher overall interest costs, while a shorter term has higher monthly payments but lower total interest.

Question 6: Do car loan calculators consider additional fees or costs?

Car loan calculators typically provide estimates based on the principal loan amount, interest rate, and loan term. They may not always include additional fees or costs associated with the loan, such as origination fees, closing costs, or loan insurance. Therefore, it is crucial to review the loan agreement carefully to understand all the associated costs.

In conclusion, car loan calculators can provide valuable insights into the potential costs of financing a vehicle. While they are not a substitute for professional financial advice, they can serve as a helpful starting point for understanding your financing options and making informed decisions.

Tips for Car Loan Calculators

This section provides practical tips for effectively utilizing car loan calculators to enhance your decision-making process.

Tip 1: Be realistic about your budget and credit score. Before using a car loan calculator, consider your current financial situation, including your monthly expenses, income, and credit score. This will give you a realistic idea of how much you can afford to borrow and the interest rates you are likely to qualify for.

Tip 2: Compare loan offers from multiple lenders. Don't rely on just one calculator or lender. Use the same loan information to compare offers from several lenders, including banks, credit unions, and online lenders.

Tip 3: Explore different loan terms. Play around with the loan term in the calculator to see how it affects the monthly payments, total interest paid, and total loan cost. This will help you determine a term that fits your financial goals.

Tip 4: Factor in additional costs. Remember that car loan calculators often don't include fees or costs beyond the principal loan amount, interest rate, and loan term. Research additional fees and costs associated with the loan and include them in your calculations.

Tip 5: Consider the trade-off between monthly payments and total interest. A longer loan term may result in lower monthly payments but higher total interest costs. A shorter loan term may have higher monthly payments but lower total interest. Choose a term that balances your monthly budget and minimizes the overall cost of the loan.

Tip 6: Review the loan agreement carefully. Before signing any loan documents, thoroughly review the loan agreement to ensure that the terms match the estimates you received from the car loan calculator. Verify the interest rate, loan term, monthly payments, and any additional fees or costs.

By effectively using car loan calculators and following these tips, you can gain a better understanding of your financing options and make informed decisions that align with your financial goals.

Conclusion on Car Loan Calculators

Car loan calculators serve as valuable tools for prospective car buyers, providing them with the ability to estimate loan costs and compare financing options. By inputting relevant financial details, individuals can gain insights into the potential monthly payments, total interest, and overall loan expenses associated with different scenarios. These calculators empower borrowers to make informed decisions by exploring various loan terms, interest rates, and down payment options, ultimately leading to a more transparent and potentially more favorable financing experience.

While car loan calculators offer valuable estimations, it is essential to remember that they provide approximate results based on the information provided. They may not reflect the precise terms offered by lenders, as interest rates and other factors can vary based on individual creditworthiness and market conditions. Therefore, it is recommended to consult with multiple lenders, review loan agreements carefully, and seek professional financial advice when making significant borrowing decisions.

Published on: 2024-10-14T18:41:53.000Z

0 Response to "A deep dive into car loan calculators: making informed financing decisions"

Post a Comment