Understanding the insurance claims process: a step-by-step guide

Understanding the insurance claims process: a step-by-step guide

Understanding the Insurance Claims Process: A Step-by-Step Guide

Understanding the Insurance Claims Process: A Step-by-Step Guide

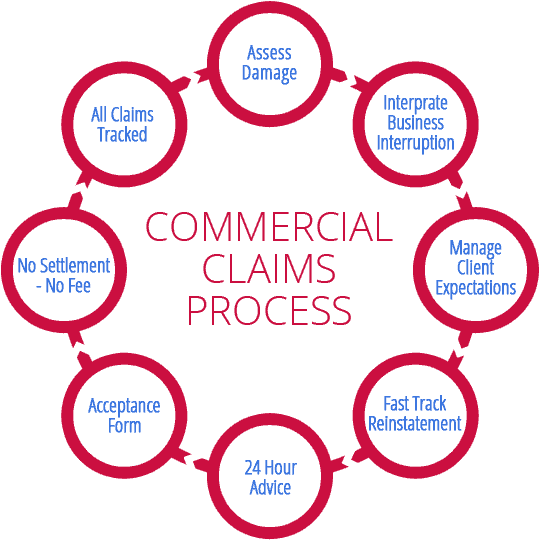

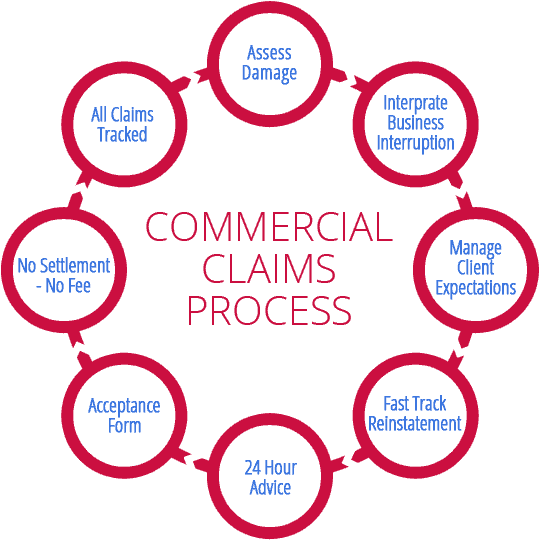

Navigating the insurance claims process can be daunting, filled with forms, deadlines, and potential complications. This guide aims to demystify the process, offering a comprehensive understanding of each step involved, from initial reporting to final settlement. By providing clarity and actionable insights, this resource empowers individuals to confidently navigate their insurance claims and achieve a successful resolution.

The insurance claims process is a crucial element of the insurance ecosystem, ensuring that policyholders receive compensation for covered losses. Historically, the process has evolved to become more streamlined and accessible, incorporating technological advancements for improved efficiency and transparency. This evolution continues, with digital platforms and online claim filing systems becoming increasingly prevalent.

This guide delves into the intricacies of the insurance claims process, breaking it down into manageable steps. It examines the crucial aspects of communication, documentation, and negotiation, while providing practical tips for maximizing claim success.

FAQs about Understanding the Insurance Claims Process

This section addresses common questions and concerns surrounding the insurance claims process, offering clarity and guidance.

Question 1: What are the essential documents required to file an insurance claim?

The necessary documentation varies depending on the type of claim and insurance policy. However, common requirements include proof of loss, such as police reports for theft or accident reports for car accidents. Policyholders should also gather any supporting documentation, including receipts, invoices, and photographs of the damage.

Question 2: How long does it typically take to process an insurance claim?

The processing time for insurance claims varies widely, influenced by factors such as the complexity of the claim, the insurer's procedures, and the availability of necessary documentation. Some claims may be resolved within a few days, while others can take several weeks or even months.

Question 3: What are the common reasons for insurance claims being denied?

Common reasons for claim denial include inadequate coverage, lack of timely reporting, failure to meet policy requirements, or fraudulent activity. Understanding the terms and conditions of the insurance policy is essential to avoid potential denials.

Question 4: How can I appeal a denied insurance claim?

The appeals process involves submitting a formal request to the insurer, outlining the reasons for disagreement with the initial decision. Policyholders should carefully review the denial reason and gather any additional documentation to support their appeal.

Question 5: What are the best practices for communicating with the insurance company during the claims process?

Maintaining clear and concise communication with the insurer is vital. Policyholders should promptly respond to requests for information, provide complete and accurate documentation, and politely but assertively advocate for their rights and interests.

Question 6: Are there any legal resources available for assistance with insurance claims?

Various legal resources can assist with insurance claims, including consumer protection agencies, legal aid organizations, and private attorneys specializing in insurance law. Seeking professional guidance can be beneficial, especially for complex or disputed claims.

Understanding the process, being prepared with necessary documentation, and communicating effectively with the insurer are key to navigating insurance claims successfully.

Tips for Understanding the Insurance Claims Process

This section offers practical tips to help policyholders navigate the claims process smoothly and effectively.

Tip 1: Read Your Insurance Policy Carefully

Thoroughly review your insurance policy, paying close attention to the terms and conditions, coverage details, and procedures for filing a claim. Understanding your policy is crucial to ensure you are adequately covered and aware of your rights and responsibilities.

Tip 2: Report the Claim Promptly

Contact your insurer immediately upon experiencing a covered loss, within the timeframe outlined in your policy. Delaying notification may jeopardize your claim or result in penalties.

Tip 3: Document Everything

Gather all relevant documentation, including photographs, receipts, invoices, and any other supporting evidence. Maintaining a detailed record of the incident, communication with the insurer, and all claim-related documents is crucial for a smooth process.

Tip 4: Be Prepared to Negotiate

The insurance company may offer a settlement that is less than the full value of your loss. Be prepared to negotiate and advocate for a fair settlement based on the terms of your policy and the extent of your damages.

Tip 5: Seek Professional Assistance When Needed

If you encounter difficulties with the claims process, or if the claim is complex, consider seeking professional assistance from an insurance broker, claims adjuster, or attorney. Their expertise can help ensure that your rights are protected and that you receive a fair settlement.

Tip 6: Understand Your Deductible

Your deductible is the amount you are responsible for paying before your insurance coverage kicks in. Understanding your deductible and its impact on your claim settlement is essential.

Tip 7: Be Patient and Persistent

The insurance claims process can take time, and you may encounter delays or obstacles along the way. Remain patient and persistent in your communication with the insurer, ensuring that your concerns are addressed and that the process progresses smoothly.

Conclusion on Understanding the Insurance Claims Process

Understanding the insurance claims process empowers policyholders to navigate this complex process with confidence. By following the outlined steps, gathering necessary documentation, and communicating effectively with the insurer, individuals can enhance their chances of a successful resolution. This comprehensive guide equips policyholders with the knowledge and tools to advocate for their rights and interests, ensuring a fair and timely outcome for their insurance claims.

The insurance claims process serves as a vital safety net for individuals and businesses, offering financial protection in times of unforeseen events. By embracing clarity, communication, and preparedness, policyholders can navigate this process effectively, leveraging insurance as a valuable resource to mitigate losses and restore normalcy in their lives.

Published on: 2024-10-06T15:06:35.000Z

0 Response to "Understanding the insurance claims process: a step-by-step guide"

Post a Comment